GFMT Global | Project Finance 2025 | Provisional Funding Desk Presentation

PDF

PDF

For use with public and non-confidential parties approved.

Description:

This PECI Funding Walkthrough introduces a non-debt, non-dilutive capital model that replaces traditional loans with hybrid-grant funding. It empowers buyers to acquire businesses or properties while receiving up to 150% of capital—no repayment, no equity loss.

How Sales Can Use It:

Sales reps can use this to demonstrate a debt-free funding advantage, especially for clients seeking acquisition capital or growth financing without bank restrictions. Position PECI as a smarter, faster capital strategy that protects ownership and cash flow while increasing deal certainty.

Description:

This PECI Funding Walkthrough introduces a non-debt, non-dilutive capital model that replaces traditional loans with hybrid-grant funding. It empowers buyers to acquire businesses or properties while receiving up to 150% of capital—no repayment, no equity loss.

How Sales Can Use It:

Sales reps can use this to demonstrate a debt-free funding advantage, especially for clients seeking acquisition capital or growth financing without bank restrictions. Position PECI as a smarter, faster capital strategy that protects ownership and cash flow while increasing deal certainty.

Download "1_GFMT Project Finance 2025-Provisional Funding Desk-CM.pdf"

GFMT Global In-House Funding Presentation v2025

PDF

PDF

For use with public and non-confidential parties approved.

Description:

This PECI-based In-House Funding Presentation outlines how sellers can receive 100%–150% of their asking price using non-debt capital while enabling buyers to acquire businesses without loans, equity dilution, or personal guarantees—driving faster, fully capitalized, no-risk transactions.

Sales Use Strategy:

Sales reps can use this document to show qualified sellers and buyers a game-changing alternative to SBA loans or private equity. Emphasize the no-debt, no-dilution model and job-creation premium to trigger interest from both investors and business owners.

Description:

This PECI-based In-House Funding Presentation outlines how sellers can receive 100%–150% of their asking price using non-debt capital while enabling buyers to acquire businesses without loans, equity dilution, or personal guarantees—driving faster, fully capitalized, no-risk transactions.

Sales Use Strategy:

Sales reps can use this document to show qualified sellers and buyers a game-changing alternative to SBA loans or private equity. Emphasize the no-debt, no-dilution model and job-creation premium to trigger interest from both investors and business owners.

Download "1_GFMT Global In-House Funding Presentation v2025.pdf"

GFMT Global | PECI Funding Matrix v2025 Q1-Q4

PDF

PDF

For use with public and non-confidential parties approved.

Description + Sales Use Strategy:

This one-page funding data sheet outlines GFMT’s Provisional Economic Capital Initiative (PECI), offering up to 150% non-recourse capital for qualified projects. Sales teams can use it as a credibility anchor during early calls to quickly qualify clients and set expectations.

Description + Sales Use Strategy:

This one-page funding data sheet outlines GFMT’s Provisional Economic Capital Initiative (PECI), offering up to 150% non-recourse capital for qualified projects. Sales teams can use it as a credibility anchor during early calls to quickly qualify clients and set expectations.

GFMT Global | Universal Mutual Non-Disclosure and Confidentiality Agreement

PDF

PDF

For use with public and non-confidential parties approved.

Description (Mutual Confidentiality Agreement PDF):

This agreement legally protects private information shared between parties during funding discussions, ensuring confidentiality and outlining limitations on disclosure.

Sales professionals can use it to reassure clients their proprietary data, deals, and interests are secured during engagement with GFMT Global Trust.

Description (Mutual Confidentiality Agreement PDF):

This agreement legally protects private information shared between parties during funding discussions, ensuring confidentiality and outlining limitations on disclosure.

Sales professionals can use it to reassure clients their proprietary data, deals, and interests are secured during engagement with GFMT Global Trust.

Download "5_GFMT Global Tr Mutual Confidentiality Agreement.pdf"

Highlight Sheet - Strategic Modernization Capital for Property Management Groups

PDF

PDF

For use with public and non-confidential parties approved.

Description (Sales Use):

This highlight sheet outlines PECI’s no-debt, no-equity-loss funding model—offering 100%–150% project capital for CRE modernization with as little as 1%–5% liquid contribution. Sales professionals can use it to position a superior alternative to conventional loans or equity dilution.

How to Use in Sales Process: Stage 1 – Hook:

Open by asking the prospect if they’ve considered modernizing or recapitalizing properties without loans or selling equity. Mention this sheet as the key that unlocks that possibility.

Stage 2 – Highlight Differentiators:

Reference specific benefits:

This sheet is a door-opener for capital-hungry prospects underserved by traditional finance.

Description (Sales Use):

This highlight sheet outlines PECI’s no-debt, no-equity-loss funding model—offering 100%–150% project capital for CRE modernization with as little as 1%–5% liquid contribution. Sales professionals can use it to position a superior alternative to conventional loans or equity dilution.

How to Use in Sales Process: Stage 1 – Hook:

Open by asking the prospect if they’ve considered modernizing or recapitalizing properties without loans or selling equity. Mention this sheet as the key that unlocks that possibility.

Stage 2 – Highlight Differentiators:

- Explain that PECI is not a loan—there's no repayment, no interest, and no ownership loss.

- Emphasize speed, institutional structure, and 1:1 to 1:30 capital matching.

Reference specific benefits:

- “Your project seems like a great fit for 100% capitalization without disrupting your equity position.”

- “Even distressed properties with debt can be repositioned using this model.”

- Mention the third-party legal oversight and AML compliance.

- Guide them to book a qualification review or email you to begin vetting.

This sheet is a door-opener for capital-hungry prospects underserved by traditional finance.

Download "1_Highlight Sheet - Strategic Modernization Capital for Property Management Groups.pdf"

Highlight Sheet - Strategic CRE Acquisition Capital

PDF

PDF

For use with public and non-confidential parties approved.

Description:

This highlight sheet presents an alternative real estate acquisition strategy tailored for principals who are prepared to contribute 10%–30% of total project capital. It positions PECI as a flexible option that complements traditional equity contributions—without triggering debt, dilution, or collateralization.

How a Salesperson Can Use It in the Sales Process:

Open the Dialogue – Ask the client: “Were you planning to bring in 10%, 20%, or 30% on your next deal?”

Bridge to the Sheet – Introduce the highlight sheet as a tool that allows their capital to go further.

Keep Language Familiar – Stay within traditional financing terms (e.g., 80/20), while subtly introducing PECI as a performance-based, non-dilutive model.

Plant the Next Step – Invite them to a scenario review session to assess how this model may apply to their acquisition plans.

Reinforce Positioning – Emphasize that this structure aligns with conventional funding posture—but opens additional pathways without new liabilities.

Description:

This highlight sheet presents an alternative real estate acquisition strategy tailored for principals who are prepared to contribute 10%–30% of total project capital. It positions PECI as a flexible option that complements traditional equity contributions—without triggering debt, dilution, or collateralization.

How a Salesperson Can Use It in the Sales Process:

Open the Dialogue – Ask the client: “Were you planning to bring in 10%, 20%, or 30% on your next deal?”

Bridge to the Sheet – Introduce the highlight sheet as a tool that allows their capital to go further.

Keep Language Familiar – Stay within traditional financing terms (e.g., 80/20), while subtly introducing PECI as a performance-based, non-dilutive model.

Plant the Next Step – Invite them to a scenario review session to assess how this model may apply to their acquisition plans.

Reinforce Positioning – Emphasize that this structure aligns with conventional funding posture—but opens additional pathways without new liabilities.

Download "2_Highlight Sheet - Strategic CRE Acquisition Capital.pdf"

Highlight Sheet - Revitalization for Debt Distressed Assets

PDF

PDF

For use with public and non-confidential parties approved.

Description:

This highlight sheet introduces a strategic funding option for sponsors managing debt-distressed assets, emphasizing the ability to retire existing loans without refinancing. PECI provides non-debt capital to stabilize, reposition, or exit assets—preserving equity and avoiding further interest accumulation or dilution.

Sales Process Use:

During discussions with clients holding troubled properties, sales reps can ask, “Are you looking to retire current debt without refinancing or giving up equity?” Then explain how PECI allows full loan payoff and recapitalization using non-recourse capital—making it ideal for distressed CRE recoveries and repositioning strategies without traditional bank constraints.

Description:

This highlight sheet introduces a strategic funding option for sponsors managing debt-distressed assets, emphasizing the ability to retire existing loans without refinancing. PECI provides non-debt capital to stabilize, reposition, or exit assets—preserving equity and avoiding further interest accumulation or dilution.

Sales Process Use:

During discussions with clients holding troubled properties, sales reps can ask, “Are you looking to retire current debt without refinancing or giving up equity?” Then explain how PECI allows full loan payoff and recapitalization using non-recourse capital—making it ideal for distressed CRE recoveries and repositioning strategies without traditional bank constraints.

Download "3_Highlight Sheet - Revitalization for Debt Distressed Assets.pdf"

Highlight Sheet - Business Acquisition Funding

PDF

PDF

For use with public and non-confidential parties approved.

Description (Business Acquisition Funding – Highlight Sheet):

This highlight sheet outlines a non-debt, non-recourse capital model for business acquisitions. It enables buyers with just 1%–5% liquidity (with a minimum of $5Million) to execute full purchases, retire existing debt, and preserve ownership—ideal for stalled transitions or succession plans.

How a Salesperson Can Use It:

Use this document early in conversations with acquisition-minded clients. Frame it as an alternative to SBA or equity financing. Ask, “If you had funding up to 150% without giving up ownership or incurring debt, what would you acquire today?” This positions PECI as a low-friction, high-leverage pathway for rapid business growth or continuity. Direct the prospect to explore a real liquidity scenario and prepare documentation for intake.

Description (Business Acquisition Funding – Highlight Sheet):

This highlight sheet outlines a non-debt, non-recourse capital model for business acquisitions. It enables buyers with just 1%–5% liquidity (with a minimum of $5Million) to execute full purchases, retire existing debt, and preserve ownership—ideal for stalled transitions or succession plans.

How a Salesperson Can Use It:

Use this document early in conversations with acquisition-minded clients. Frame it as an alternative to SBA or equity financing. Ask, “If you had funding up to 150% without giving up ownership or incurring debt, what would you acquire today?” This positions PECI as a low-friction, high-leverage pathway for rapid business growth or continuity. Direct the prospect to explore a real liquidity scenario and prepare documentation for intake.

Download "4_Highlight Sheet - Business Acquisition Funding.pdf"

Highlight Sheet - Capital Solutions for Developers & Construction Groups

PDF

PDF

For use with public and non-confidential parties approved.

Description:

This highlight sheet outlines non-debt, non-repayable capital solutions tailored for developers and construction groups. It enables full project funding (100–150%) with only 1–5% principal liquidity stake allocation, with a minimum of $5Million, preserving ownership and liquidity.

Sales Process Guidance:

Sales reps should present this sheet after confirming project size and developer role. Ask, “Were you budgeting for a 90/10, 80/20, or 70/30 model?” Then explain how PECI allows qualified principals to move forward with only 1–5% liquidity—no debt, no equity loss. Use real-world scenarios from the sheet to reinforce credibility and trigger interest. Set a follow-up for documentation alignment and intake.

Description:

This highlight sheet outlines non-debt, non-repayable capital solutions tailored for developers and construction groups. It enables full project funding (100–150%) with only 1–5% principal liquidity stake allocation, with a minimum of $5Million, preserving ownership and liquidity.

Sales Process Guidance:

Sales reps should present this sheet after confirming project size and developer role. Ask, “Were you budgeting for a 90/10, 80/20, or 70/30 model?” Then explain how PECI allows qualified principals to move forward with only 1–5% liquidity—no debt, no equity loss. Use real-world scenarios from the sheet to reinforce credibility and trigger interest. Set a follow-up for documentation alignment and intake.

Download "5_Highlight Sheet - Capital Solutions for Developers & Construction Groups.pdf"

Highlight Sheet - Strategic At Risk and Bankruptcy Recovery

PDF

PDF

For use with public and non-confidential parties approved.

Description:

This highlight sheet outlines how PECI provides an alternative capital path for CEOs and attorneys navigating Chapter 11 or distressed restructuring—offering full debt retirement without court-imposed oversight, equity forfeiture, or creditor interference. It repositions viable enterprises for rapid private recovery.

Sales Process Integration:

Begin conversations with bankruptcy counsel or turnaround professionals by acknowledging the systemic issues with traditional DIP financing:

“Are you finding DIP terms too predatory, too slow, or too court-constrained?”

“Has investor fatigue or equity dilution become a barrier to timely recovery?”

“What if you could retire the toxic debt stack entirely—without triggering more creditor rights or Chapter 11 oversight?”

Present the sheet as a framework for confidential alternatives to Chapter 11’s limitations. Emphasize PECI’s capacity to deliver non-recourse, non-dilutive recovery capital outside the court, preserving executive control and future exit value. For CEOs, pivot to how this unlocks strategic growth without surrendering equity, reputation, or timeline.

Use the document to reframe: This isn’t rescue capital. It’s a legal and financial realignment. Then propose a private capital scenario review with legal oversight if requested.

Description:

This highlight sheet outlines how PECI provides an alternative capital path for CEOs and attorneys navigating Chapter 11 or distressed restructuring—offering full debt retirement without court-imposed oversight, equity forfeiture, or creditor interference. It repositions viable enterprises for rapid private recovery.

Sales Process Integration:

Begin conversations with bankruptcy counsel or turnaround professionals by acknowledging the systemic issues with traditional DIP financing:

“Are you finding DIP terms too predatory, too slow, or too court-constrained?”

“Has investor fatigue or equity dilution become a barrier to timely recovery?”

“What if you could retire the toxic debt stack entirely—without triggering more creditor rights or Chapter 11 oversight?”

Present the sheet as a framework for confidential alternatives to Chapter 11’s limitations. Emphasize PECI’s capacity to deliver non-recourse, non-dilutive recovery capital outside the court, preserving executive control and future exit value. For CEOs, pivot to how this unlocks strategic growth without surrendering equity, reputation, or timeline.

Use the document to reframe: This isn’t rescue capital. It’s a legal and financial realignment. Then propose a private capital scenario review with legal oversight if requested.

Download "6_Highlight Sheet - Strategic At Risk and Bankruptcy Recovery.pdf"

PECI In-House Funding Walkthrough v2025

PDF

PDF

For use with public and non-confidential parties approved.

Description:

This PECI walkthrough equips sellers and agents to advertise “In-House Funding Available,” unlocking full-price exits. Qualified buyers can close with a non-debt liquidity stake starting at $5 million—positioning businesses priced from $100M+ for rapid, no-dilution acquisition.

Sales Process Guide: Engaging Seller First, Then Buyer

Step 1: Approach Seller or Listing Agent

Hook: “Would you like to advertise your business listing as ‘In-House Funding Available’—with no discount, no seller financing, and fast closings?”

Value Proposition:

Seller gets full ask price with no financing risk.

Agent gains a major differentiator to attract capital-ready buyers.

Explain PECI: A structured funding model allows approved buyers to secure full acquisition capital using private economic match systems—not traditional loans, not equity dilution.

Step 2: Update the Listing

Label as “PECI-Enabled | In-House Capital Available” to immediately attract serious inquiries.

Distribute the walkthrough to validate legitimacy and invite prequalified buyers.

Step 3: Engage Buyer Upon Interest

Prequalify Quickly: “Do you have a minimum of $5 million in available liquidity? That allows you to unlock PECI-backed acquisition capital for businesses priced $100M and above.”

Highlight Structure:

Capital is allocated through a private economic structure with no interest, no dilution, and no repayment schedules.

Confidence Builder: “You control the company post-close. No lenders. No investors on the cap table. Just capital match and clear runway.”

Step 4: Facilitate Deal Closure

Refer seller and buyer to onboarding attorneys or capital desk.

Use the walkthrough as your script + visual aid to reinforce clarity and trust.

Description:

This PECI walkthrough equips sellers and agents to advertise “In-House Funding Available,” unlocking full-price exits. Qualified buyers can close with a non-debt liquidity stake starting at $5 million—positioning businesses priced from $100M+ for rapid, no-dilution acquisition.

Sales Process Guide: Engaging Seller First, Then Buyer

Step 1: Approach Seller or Listing Agent

Hook: “Would you like to advertise your business listing as ‘In-House Funding Available’—with no discount, no seller financing, and fast closings?”

Value Proposition:

Seller gets full ask price with no financing risk.

Agent gains a major differentiator to attract capital-ready buyers.

Explain PECI: A structured funding model allows approved buyers to secure full acquisition capital using private economic match systems—not traditional loans, not equity dilution.

Step 2: Update the Listing

Label as “PECI-Enabled | In-House Capital Available” to immediately attract serious inquiries.

Distribute the walkthrough to validate legitimacy and invite prequalified buyers.

Step 3: Engage Buyer Upon Interest

Prequalify Quickly: “Do you have a minimum of $5 million in available liquidity? That allows you to unlock PECI-backed acquisition capital for businesses priced $100M and above.”

Highlight Structure:

- PECI is not a loan.

Capital is allocated through a private economic structure with no interest, no dilution, and no repayment schedules.

Confidence Builder: “You control the company post-close. No lenders. No investors on the cap table. Just capital match and clear runway.”

Step 4: Facilitate Deal Closure

Refer seller and buyer to onboarding attorneys or capital desk.

Use the walkthrough as your script + visual aid to reinforce clarity and trust.

Industries We Serve

________________

Retail

Restaurants

Health Care

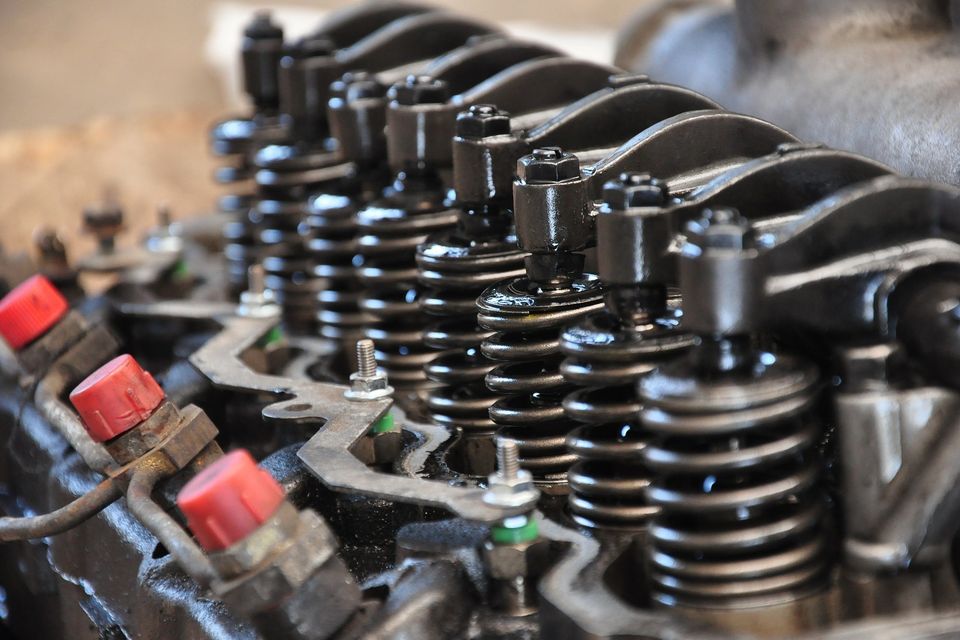

Automotive

Marketing

Travel & Tourism

Government

Maritime

Aerospace & Defense

Construction

Internet

Science

Education

Engineering

Agriculture

Don't See Your Industry Listed?

The above list is just a sample of the types of businesses we serve. If your industry is not listed we encourage you to contact us for more information.